Is your business model minimizing financial risk for your customers?

I've written in the past about business model innovation, and how companies can not only innovate with their product, but also with the way they charge their customers and garner revenue.

A business model innovation that I like and have been noticing recently is one that that minimizes the financial risk for its customers. While the free trial and freemium models do this to a certain extent, some companies go even further.

There are two models that I highlight in this post:

When companies provide a service first, and get paid later when a certain event occurs

When companies have you pay first but then refund money if you don't use the product in a given time frame

Here are three companies that do a great job of minimizing financial risk for their customers.

Lambda School

Studies from Georgetown University and Pew Research Center have shown that college graduates make significantly more per year, and over a lifetime, than their counterparts with no four-year college degree. That's a comforting statistic for college grads, current students, and those thinking about attending.

But there is a lot of risk in attending college.

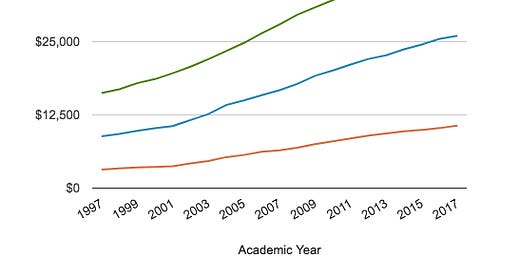

First of all, the cost of attending college has become astronomical.

Tuition and fees at ranked private schools average over $41,000, with some of the top schools charging over $55,000 per year. Yucky to the bank account.

Growth of college tuition - graph courtesy of US News

So unless you have rich parents who can pay for your education (lucky you), or you ace all of your high school classes and entrance exams and get a full scholarship (smart you), you're likely going to have to take out student loans. And these loans will follow you around forever, even if you declare bankruptcy.

Second, even if you graduate college, you might not get a job upon graduation, or months or even years after. That's pretty terrible.

Because of this increased risk of attending college, there's been a growth in popularity of vocational programs and coding bootcamps like General Assembly, Flatiron School, and many others that have come and gone. These programs can either be in-person or online and teach you tech-related skills like web development and digital marketing. Classes typically last a few months, depending on whether you're a full- or part-time student.

The problem is that these programs are still pretty expensive (full-time, in-person coding bootcamps can cost up to $20,000) and you're still not guaranteed a job after you graduate. So are these programs really solving the problem?

Lambda School has a really innovative business model that aims to minimize their students' risk of gaining a useful education.

Lambda School provides computer science and data science courses taught live and online by instructors who have worked for the largest tech companies like Google and Apple.

The big differentiator is that you don't pay a cent for this education until you graduate and make more than $50,000 per year in salary. At that point, you pay 17% of your salary for two years.

So let's say you graduate from Lambda School and get a job as a Data Scientist making $75,000 per year. 17% of $75,000 is $12,750; assuming you don't get a raise within your first two years, you would pay $25,500 to Lambda School.

That's less than one semester's worth of tuition and fees at some universities.

With no upfront monetary investment.

And you already have a high-paying job before you pay anything.

That's pretty amazing.

I'm not sure how innovative their curriculum is; live online education has certainly been tried before. It's the de-risking of the cost of the education that's really innovative.

I learned about Lambda School from this episode of This Week in Startups. The founder, Austin Allred, shares a ton of info about why college tuitions have soared and why he started Lambda School.

Education is one of the most important sectors of our economy and it's clearly broken. I'm rooting hard for Austin and Lambda School to succeed so this huge problem can be fixed.

MaxSalePrice

Selling a home is a stressful task and a lot of work.

You need to make your home look nice, work with agents, price it correctly, give tours, and much more, in a short amount of time.

In the end, you want to maximize the sales price of your home. And one way to do this is to do home improvement projects before you put your house on the market. A remodeling of your kitchen, new hardwood floors, and a fresh coat of paint can significantly increase the value of your home.

These projects aren't cheap, though. A kitchen remodel can cost over $40,000, a full paint job can cost $10,000, and installing hardwood floors can be many thousands as well.

And you have to find trustworthy contractors and pay them upfront to do this work.

is flipping this model on its head.

The company will work with you and your real estate agent to figure out what improvements are needed to maximize your sale price. Then their contractors will execute these projects, and you don't pay until you close the sale of your home, regardless of how long it takes to sell it.

Everyone wins here. You maximize your revenue from your home, your agent gets her cut of a bigger pie, and MaxSalePrice gets paid for its work.

I know the company's CEO, Rick Rudman, pretty well. He started and sold his PR software company Vocus for nearly $500 million and was the CEO of social media software Tracx. The more he told me about MaxSalePrice, the more interesting it sounded. I think it's a really great business model and I'm sure MaxSalePrice will be really successful with Rick at the helm.

Slack

Workplace communication provider Slack does many things really well, and their business model is one of them.

Slack has a pretty amazing free plan. You get unlimited public and private channels, 10,000 searchable messages, up to 10 apps, and much more. It's very compelling for small teams.

Once you grow out of that plan, Slack can cost up to $15 per user per month.

The innovative aspect of their business model is what they call "Fair Billing Policy", where your company will only get billed for the people who use it each month. So if an employee you've already paid for becomes inactive, Slack will add a prorated credit to your account for the unused time.

There are very few enterprise apps that get used by every employee every single day. Even though Slack is likely to be one of these apps, they still minimize financial risk for their customers by providing refunds for inactive users.

That's a characteristic of a truly customer-centric company. It's no wonder why they're valued at more than $5 billion.

Conclusion

I really love it when companies innovate with their business models, and these three companies are doing a great job of taking care of their customers' wallets.

It has really made me think of how to structure pricing for my startup, WinOptix, and how I can de-risk this process for my customers.

Have you seen other companies whose business models help minimize financial risk for their customers? Are you doing so for your customers?

I'd love to hear your thoughts in the comments.