3 examples of startups who innovate on business model, not just product

The startup world is hot right now and there are so many companies vying to be the next big thing. If you read TechCrunch, The Verge, or any other startup or technology publication, you'll be inundated with content about hundreds of companies with similar-sounding solutions.

If you're a potential customer of some of these options, you might wonder - how are these companies different from each another?

Another enterprise communication software company just launched as I write this - how will it be different from Slack, Yammer, HipChat, or the 100 other tools out there?

Sweet, another project management app? I already use two of them, so might as well sign me up for a third, right?

Someone else just built a platform where you can get meals delivered to your home - should I use that one, or Munchery, Sprig, Maple, or the 30 other options that I have?

Most of the differentiation among these companies, if any, comes from the product, which makes a lot of sense. You can see or feel the differences in product and user experience, so they have the most immediate impact on the potential customer.

But what's more interesting to me are companies that innovate and differentiate on business model. They deliver a great product (which is a necessity), but the way they significantly separate themselves from their competition is by delivering a unique solution based on how they charge their customer, and not just the product they deliver.

Here are three examples.

Zenefits - free software, commissions on insurance sales

Zenefits is free software that allows small and medium businesses to manage all of their human resource tasks, such as benefits, payroll, time off, and more, all in one platform. Competitors include BambooHR, Vista HCM, TribeHR, Zoho People, and many others.

It's been labeled as one of the fastest-growing software-as-a-service (SaaS) companies ever.

I'm not expert in HR management solutions, nor have I used any of these software packages. While Zenefits may differentiate itself a bit by having a better product, that's not the point. The way they have really innovated is with their business model.

While other solutions charge their customers based on number of employees in the company or users of the software, Zenefits gives its software away for free.

Not a free trial. Not freemium. FREE 4EVA. This is basically unheard of in the enterprise software world.

Zenefits makes money by becoming the insurance broker for all of their customers and earns commissions for any health, dental, vision, and other insurance that is sold and managed through the platform.

Genius.

Venture capitalist Tom Tunguz calls this a "software-enabled marketplace" and this model, when executed correctly, can lead to dominating market positions, which Zenefits is well on its way to achieving.

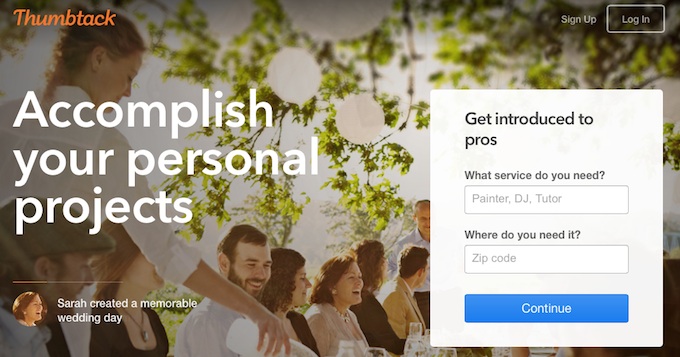

Thumbtack - charge per contact, not per transaction

Thumbtack is a website where you can find a professional local service provider to help you complete any project such as remodeling your home, tutoring your child, or refreshing your resume.

Sound familiar? It should, as there are tons of similar sites - Craigslist, Angie's List, HomeAdvisor, Red Beacon, and Zaarly, just to name a few.

While many of these companies charge service providers a fee per transaction, Thumbtack differentiates by charging these contractors each time they contact a potential customer.

The company initially charged transaction fees and also tried a subscription-based model, but pivoted toward the charge-per-contact model because they found that this better scaled to the activity of the marketplace and acted as a pre-screener for each potential customer.

This is a perfect example of the Build-Measure-Learn principle of the Lean Startup where companies can use a consistent experimentation process to achieve success. In most cases, companies use the Build-Measure-Learn process to make changes to its product, but Thumbtack used it to alter its business model.

With a $100 million fundraise a year ago, I'd say Thumbtack made some smart decisions.

Robin Hood - no trading fees

Robin Hood is a mobile app where you can trade stocks for free with no account minimums, while other online brokers such as eTrade, Charles Schwab, and TD Ameritrade charge around $10 per transaction with account minimums of $500 or more.

Robin Hood recognized that the millennial segment is a group that is largely untapped by financial services firms, and the company understood that in order to get this segment active in investing, barriers like trading fees, account minimums, and complicated tools and interfaces needed to be abolished.

With little to no overhead (as opposed to many other online brokers, who have to maintain brick-and-mortar locations and pay financial advisors and administrative staff), Robin Hood is able to let its users trade stocks for free.

The company makes money by accruing interest from users' uninvested cash balances, and is testing the collection of interest from those who upgrade to a margin account.

This is a case of a company recognizing a hole in the financial services market, understanding its target customers, and finding a way to cater to them.

Conclusion

Zenefits, Thumbtack, and Robin Hood are three examples of startups who figured out a way to differentiate themselves from the competition using their business models, and not just their products.

These companies were really smart in understanding their customer really well and figuring out the best way to monetize their users.

While innovating on product is still extremely important, I really appreciate when companies can find inventive business models that works well for both the end user and the organization.

Your turn

What do you think of the above companies who are innovating on business models? Do you have any other examples who are doing the same? I'd love to hear more in the comments.

I hope you found this interesting! If so, please share this article, sign up for my email list below, then connect with me on Twitter, Google+, and LinkedIn for future updates.